How Emerging Orthopedic Technologies Are Changing Commercial Strategy

02 Oct, 20255 minutesOrthopedic medical devices are entering a new era of digital capability, from robotic surger...

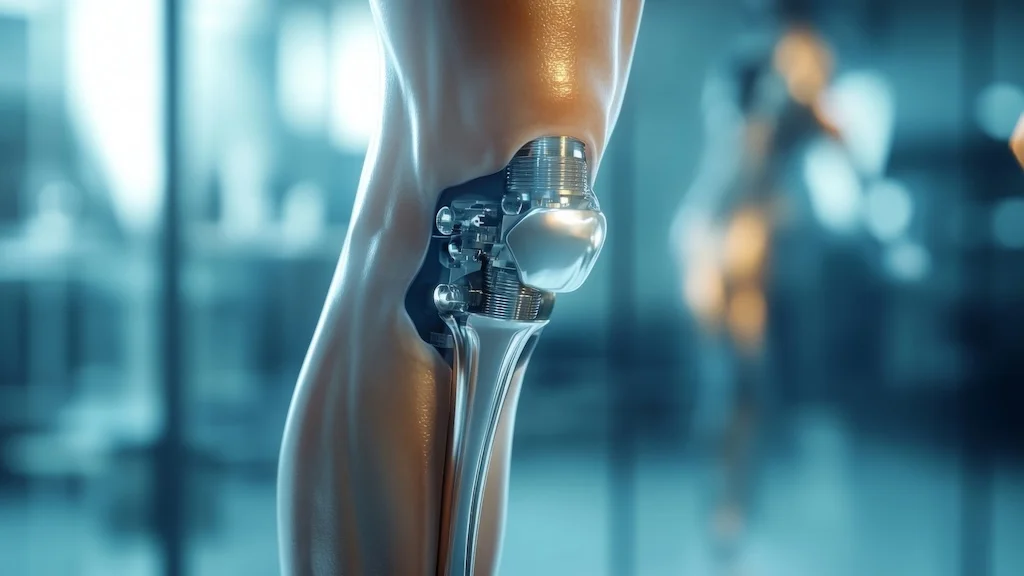

Orthopedic medical devices are entering a new era of digital capability, from robotic surgery platforms to mixed reality tools enhancing intraoperative precision. Yet while the technology accelerates, many companies remain bound by outdated hiring frameworks.

Surgeons may be ready to trial the latest navigation systems, but are commercial teams ready to educate, influence, and execute across extended sales cycles? This blog explores how breakthrough orthopedic technologies are changing surgical outcomes and the very strategies required to bring innovation to market.

Want the full breakdown? Download our orthopedic devices guide for insights into product adoption, go-to-market strategy, and the talent models built to support both.

Where Legacy Hiring Models Fall Short

Orthopedic medical device companies often continue to recruit using structures built for a different era, one where product differentiation was clearer, cycles were shorter, and technical fluency wasn’t as critical. Today’s technologies require sales professionals who can combine clinical depth with capital equipment sales strategy.

Legacy hiring models struggle in three key areas:

- Clinical-commercial fluency: Hiring teams often prioritise sales pedigree over surgical understanding, leading to mismatched field teams.

- VAC navigation experience: With multi-stage procurement processes and VAC approvals now standard, hires need to be comfortable working cross-functionally and influencing long buying cycles.

- Post-sale support expectations: The support model now includes in-theatre guidance, clinical training, and integration troubleshooting. Many roles blur traditional commercial lines.

Without adapting hiring frameworks, companies risk slowed adoption, poor surgeon engagement, and underperformance in key markets.

Finding the Best Commercial Talent

The complexity of modern orthopedic medical devices means that commercial teams must operate like strategic partners by understanding reimbursement structures, building trust with surgeons, and navigating multi-stakeholder buying processes with confidence.

To succeed, companies must align hiring practices with the demands of today’s go-to-market environments:

- Surgeon influence and advocacy: KOLs and early adopters play an outsized role in validating new technology. Field teams need the credibility to engage at this level.

- Sales cycles that start in the OR: Many capital decisions now begin with clinical interest. Hires should be able to support live cases, answer procedural questions, and communicate clinical impact fluently.

- Cross-functional orchestration: From market access to clinical education, successful commercial teams collaborate across functions to deliver a unified value case.

Meeting the Complex Commercial Demands of a Go-To-Market Strategy

Commercialization isn’t keeping pace with technological advancements. The latest robotic surgery systems, mixed reality navigation tools, and wireless implant platforms are setting new standards for accuracy. Yet many organizations underestimate what it takes to bring these innovations to market.

For example, Think Surgical’s TMINI™ is a wireless handheld robot for knee arthroplasty that supports broad implant compatibility and intraoperative positional refinement. LEM Surgical’s Dynamis system, launching in the US, combines multi-arm robotics, AI, and imaging integration on a single compact platform. Devices like Gyder’s image-free hip system or Polaris AR’s mixed-reality STELLAR Knee are pushing boundaries of surgeon-led precision.

While these technologies promise shorter recovery times and less invasive procedures, their adoption is far from guaranteed. Commercial success often hinges on:

- Gaining early KOL and surgeon advocacy

- Securing VAC approvals and building a reimbursement case

- Educating clinicians on novel workflows and outcomes

Sales cycles can stretch 12–18 months, especially for capital equipment. To convert clinical innovation into market share, companies need commercial teams equipped to handle complexity from the first conversation to full OR integration.

Bringing Innovation to Market Starts with the Right Team

The latest advances in Orthopedic devices hold clear clinical value. But success doesn’t stop in the OR. It depends on whether companies can build commercial teams capable of navigating long sales cycles, engaging KOLs, and supporting complex product integration.

If your current talent model was built for a different generation of medical device, it’s time to rethink how you hire.

The Barrington James guide explores how emerging technologies are transforming both surgical precision and commercial strategy.

Download the guide to learn how Orthopedic leaders are aligning innovation with talent and gaining a competitive edge.

Orthopedic technologies like robotics, AR, and wireless implants are reshaping surgical outcomes, but outdated hiring models are slowing commercialization. Success now depends on commercial teams with clinical fluency, capital equipment expertise, and the ability to navigate long sales cycles. This blog explores why talent strategy must evolve alongside innovation and how companies can future-proof their go-to-market approach.