Merck to Acquire Verona Pharma for $10 Billion, Adding Breakthrough COPD Drug Ohtuvayre

09 Jul, 20252 minsThe deal in detailIn this agreement, Merck will pay $107 each American Depository Share, val...

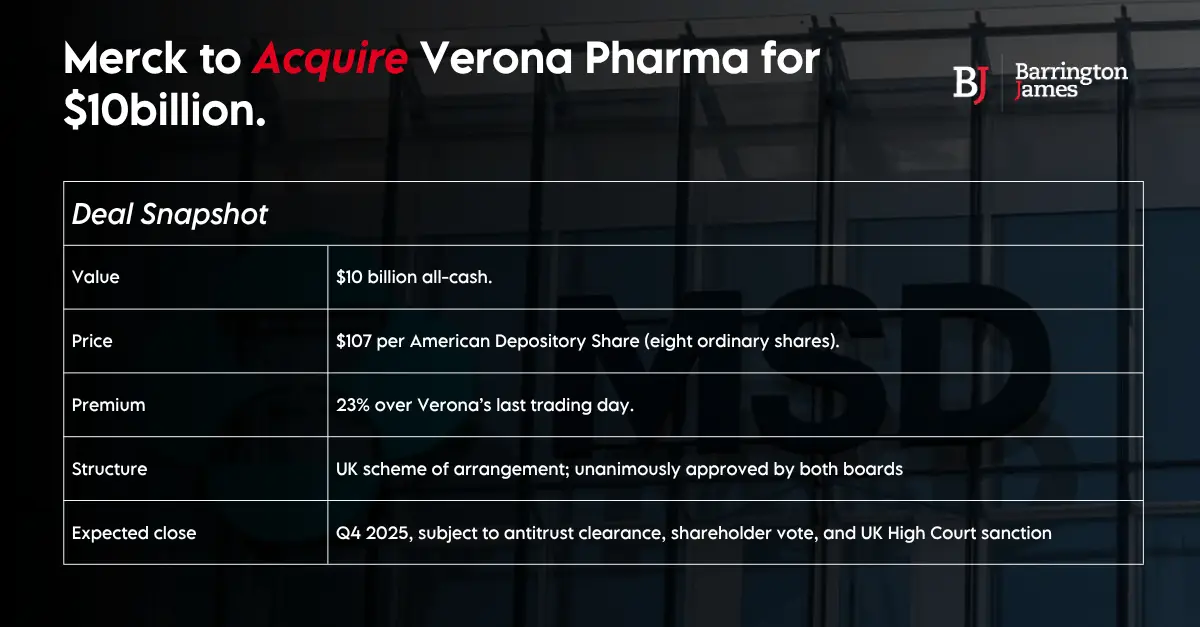

The deal in detail

In this agreement, Merck will pay $107 each American Depository Share, valuing Verona Pharma at $10 billion in cash. The offer is a 23% premium to Verona's previous close and has received full board approval from both businesses. Completion is planned in Q4 2025, subject to antitrust clearance, shareholder approval, and High Court sanction.

Why Verona?

Ohtuvayre, which was approved by the FDA on June 26, 2024, is the first innovative inhaled maintenance medication for COPD in over 20 years. It works as a dual PDE3/4 inhibitor, providing bronchodilator and anti-inflammatory effects. In Q1 2025, the medicine produced $71.3 million and around 25 000 prescriptions, indicating rapid market penetration.

Strategic context

Merck has spent more than $30 billion on business-development since 2023 to diversify ahead of the 2028 Keytruda patent cliff. Adding a high-growth respiratory asset boosts near-term revenue and deepens Merck’s cardio-pulmonary pipeline.

Market & talent impact

COPD affects 11.7 million US adults and costs $50 billion annually, so Merck’s move raises demand for specialists in inhaled-drug development, manufacturing and commercialization. As Verona’s niche workforce is absorbed, hiring managers across biopharma will face tighter supply of respiratory talent making speed and specialist networks critical.