Trump's 15% EU Pharma Tariff & Price Match Ultimatum: What This Means

05 Aug, 20253 MinsOn the 28th of July, the US and the EU agreed a baseline of 15% import tariff that explicitl...

On the 28th of July, the US and the EU agreed a baseline of 15% import tariff that explicitly covers pharmaceutical. (Reuters, 2025) Then just a few days later on the 31st of July, President Trump sent letter to 17 global drugmakers demanding that US patients pay no more than the "most-favoured-nation" (MFN) price they already offer overseas, giving firms until 29th September 2025 to comply. (The White House, 2025) Analysts say the tariff plus MFN mandate could add $13-19$ billion in annual costs for European manufacturers and has already knocked 1-4% off leading share prices. (Reuters, 2025)

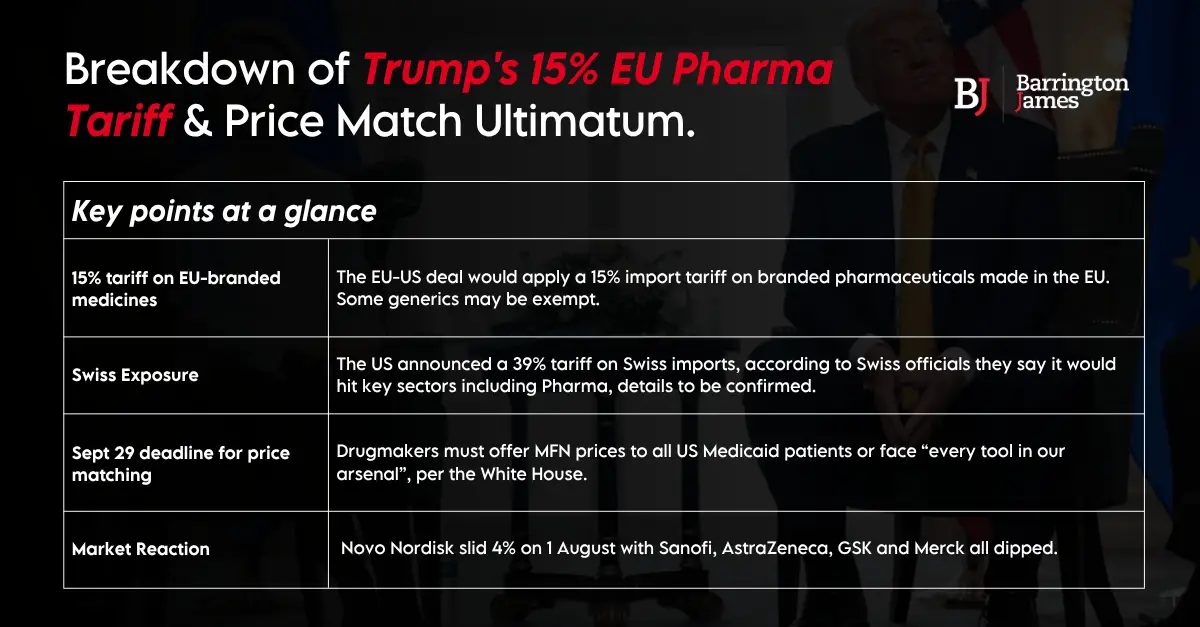

Key points at a glance

- 15% tariff on EU-branded medicines - The EU-US deal would apply a 15% import tariff on branded pharmaceuticals made in the EU. Some generics may be exempt.

- Swiss Exposure - The US announced a 39% tariff on Swiss imports, according to Swiss officials they say it would hit key sectors including Pharma, details to be confirmed.

- Sept 29th deadline for price matching - Drugmakers must offer MFN prices to all US Medicaid patients or face “every tool in our arsenal”, per the White House.

- Market Reaction - Novo Nordisk slid 4% on 1 August with Sanofi, AstraZeneca, GSK and Merck all dipped.

What does the tariff + MFN combo really do?

Margin Squeeze

EU sales may subsidise cheaper US prices, shrinking EBIT margins.

Regulatory Complexity

Dual-pricing bans force renegotiation of EU supply contracts and dossiers.

Supply-chain Pivots

15% duty revives talk of US fill-finish or secondary packaging hubs.

Talent Gaps

Urgent need for market access economists, trade compliance leads and pricing analytics pros.