Why Orthopedic Commercial Hiring Keeps Falling Short

25 Sept, 20255 minutesOrthopedic medical devices are advancing faster than most commercial teams can keep up....

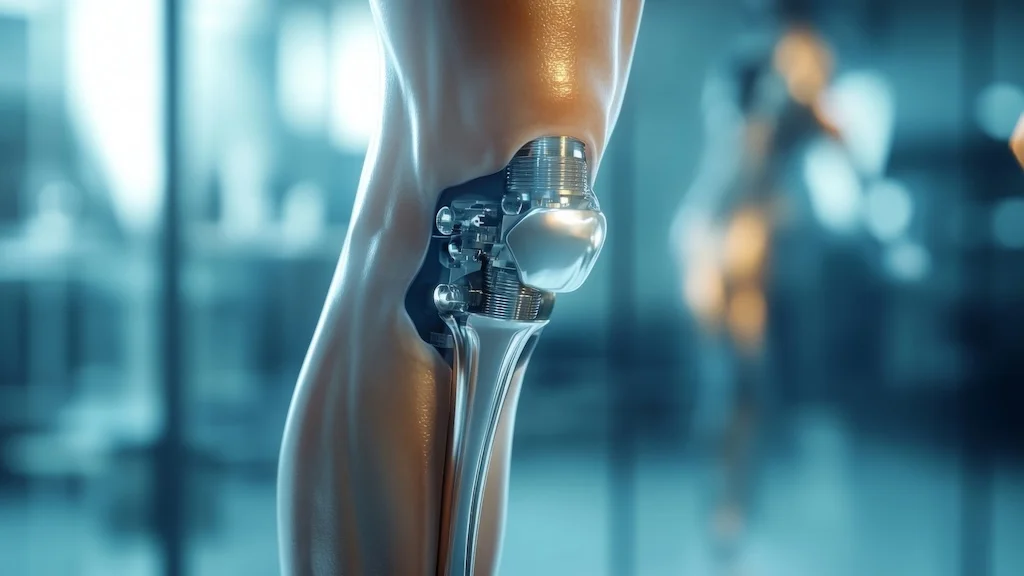

Orthopedic medical devices are advancing faster than most commercial teams can keep up. New devices are going to market with incredible technical potential, but they demand a very different kind of commercial support.

Despite impressive clinical data, many Orthopedic platforms face inconsistent usage and drawn-out procurement cycles. Often, the problem isn’t the product but the people tasked with selling and supporting it. Traditional hiring models, rooted in older sales dynamics, are proving unfit for purpose in a market defined by complex stakeholder maps and long capital sales cycles.

This blog explores where commercial hiring is breaking down in Orthopedics, and why legacy recruitment approaches are hindering growth. Our strategic guide, offers deeper insight into how the right people can help turn innovation into real market traction.

The Misalignment in Commercial Talent

Capital equipment, particularly in robotic surgery and AR platforms, has changed Orthopedics because the transactions are now strategic investments involving months of negotiation, value analysis committee approvals, and surgeon buy-in.

Yet many companies still rely on hiring playbooks designed for faster-moving consumable sales or legacy implants. This leads to commercial hires who lack the stakeholder engagement skills or strategic patience needed to succeed in these roles. High-performing salespeople today must:

- Communicate technical value to non-clinical stakeholders

- Partner credibly with surgeons to influence adoption

- Navigate reimbursement conversations and VAC processes

- Sustain momentum across 12-18 month sales cycles

Hiring for these demands calls for commercial acumen blended with clinical intuition. Without that, even the most innovative device risks commercial failure.

Outdated Hiring Models

Outdated hiring models continue to slow progress in Orthopedics device sales. Here are some of the most common ways we see traditional recruitment approaches falling short:

Functional silos.

Commercial and clinical teams often operate in isolation, resulting in hires who can’t bridge the gap between technical insight and customer impact.

Over-valuing tenure.

Many firms still default to hiring based on time served in adjacent sectors, rather than seeking capabilities suited to the demands of capital equipment sales.

Stretched internal teams.

In-house recruiters are often managing multiple verticals with limited access to passive candidates or niche networks. As a result, critical roles are left open too long or filled reactively with candidates that aren’t the ideal match.

Underestimating the sales cycle.

Companies underestimate how long it takes new hires to build influence with surgeons, navigate VAC committees, and drive adoption. When the sales cycle stretches 12–18 months, mis-hires are costly.

Recruitment for Growth

The good news is that forward-thinking Orthopedic firms are changing. Instead of defaulting to traditional sales archetypes, they’re reassessing what excellence looks like.

However, success increasingly depends on candidates who can work cross-functionally, engage technical and clinical audiences, and sustain long-term relationship building.

Strategic hiring partners can also play a key role. With access to niche talent pools and insight into sector-specific pressures, specialist recruiters can help medical device companies:

- Build credible and clinically-informed commercial teams

- Reduce time-to-hire for hard-to-fill roles

- Avoid costly mis-hires in pivotal growth phases

Adapting your hiring strategy is not about replacing internal teams but complementing them with insight, reach, and precision when it matters most. Without the right commercial infrastructure, even the most advanced platforms risk underdelivering.

If your business is rethinking how it builds and scales commercial teams, the full whitepaper offers a detailed roadmap.

Access it here: Emerging Technologies and Evolving Talent Strategies in Orthopedic Devices.

Orthopedic devices are advancing rapidly, but outdated hiring models are holding back commercialization. Complex capital equipment sales demand talent with both clinical fluency and commercial acumen, yet many firms still rely on legacy playbooks. This blog explores where recruitment is breaking down in Orthopedics and why evolving talent strategies are essential to turn innovation into adoption.